- #DEFAULT RISK PROBABILITY SCALE FOR FINANCE ON BLOOMBERG HOW TO#

- #DEFAULT RISK PROBABILITY SCALE FOR FINANCE ON BLOOMBERG LICENSE#

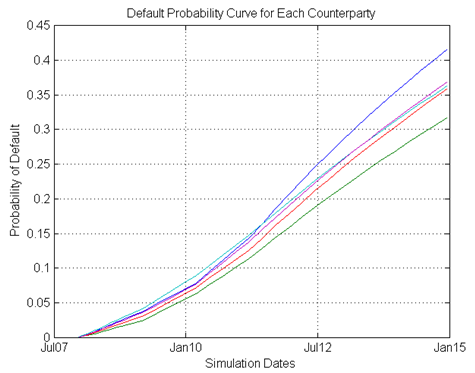

It is available to Bloomberg Data License clients, as well as on the Bloomberg Terminal through a new dedicated screen, and via the Excel API. MIPD includes implied probability of default for over 36,000 issuers and multiple sectors across the term structure from 1 to 20 years. “By quantifying market sentiment underpinned by BVAL’s rich data sets, MIPD provides a powerful early warning creditworthiness assessment for a wide range of issuers across the curve that can help investors navigate changing market conditions based on both issuer-specific news as well as market-wide events.” The default risk factor is constructed by estimating the probability of default using a hybrid version of dynamic panel probit and artificial neural network. According to the Bloomberg Credit Risk Model, if stock price volatility increases, the probability of default will increase Piotroski finds in 'Value Investing', that the portfolio benefits of financial statement analysis in high Book to Market (BM) firms is primarily concentrated in small and medium sized firms, companies with low share.

“Market participants are generally aware of potential credit issues ahead of official rating downgrades or defaults, and while credit default swap prices can serve as indicators, they are often limited with fewer issuers traded and reduced liquidity,” explains Brad Foster, global head of Enterprise Data Content at Bloomberg. Historically, practitioners have focused on the one-year probability of default (PD) calculation using a firm’s financial information, because the default has mostly been modeled as a binary event (except the intensity model), suited for single-period (one-year) considerations within the regulatory framework of a fixed planning horizon. Dual risk rating systems 3 Dual risk rating systems (DRRs) are on the opposite end of the spectrum in that they are developed using statistical models to predict expected loss based on the borrower’s ability to repaythe probability of default (PD)and the value of collateral recovery in the event of defaultthe loss given default (LGD).

It also helps anticipate credit deterioration, such as major rating downgrades and defaults ahead of traditional credit analysis, allowing clients to make risk and investment decisions confidently. In any case, we must keep in mind that this assumption does not preclude us from considering while continuing to observe the constraint of financial. The product provides clients with a highly responsive, transparent, daily credit risk assessment that incorporates data from BVAL, Bloomberg’s evaluated pricing service, to proactively estimate fixed income market sentiment and quickly react to changing market and issuer-level conditions. MIPD enables clients to incorporate creditworthiness metrics within existing workflows for a more holistic approach to credit risk management. JEL Classification: C15 C63 G31 G32 G33.Bloomberg has made its Market-Implied Probability of Default (MIPD) product, a market-driven creditworthiness indicator, available to both Enterprise Data and Bloomberg Terminal clients globally. Keywords: capital budgeting, corporate valuation, credit risk, discounted cash flow (DCF), expected loss, loss given default (LGD), monte carlo simulation, probability of default, stochastic model, unexpected loss. The focus of this paper is on the theoretical and modeling aspects of the new methodological approach proposed however we also present an application of the method that represents just one example of its possible implementations, and the results of a comparative test (covering RAPD, Altman Z-score, two option-contingent models and S&P ratings) which in our opinion constitutes a preliminary positive empirical support of the validity of the RAPD Approach. NEW YORK, J/PRNewswire/ - Bloomberg today announced its Market-Implied Probability of Default (MIPD) product, a fully market-driven creditworthiness indicator, is now available. Subsequently, we compare the RAPD model with option/contingent models, inasmuch as both models use the same definition of the event of default. Bloombergs Default Risk product provides an independent evaluation of a companys credit health using fundamental data and cutting-edge quantitative models.

#DEFAULT RISK PROBABILITY SCALE FOR FINANCE ON BLOOMBERG HOW TO#

First, we present the model then we show how to extend the model to estimate company specific loss given default, expected loss and unexpected loss as well. The Bloomberg Default Risk ( DRSKWe formulate the model in a discrete time frame, apply capital-budgeting techniques to define the relationships that identify the default condition, and solve the model by Monte Carlo simulation.

We present a stochastic simulation model for estimating forward-looking corporate probability of default and loss given default.

0 kommentar(er)

0 kommentar(er)